-

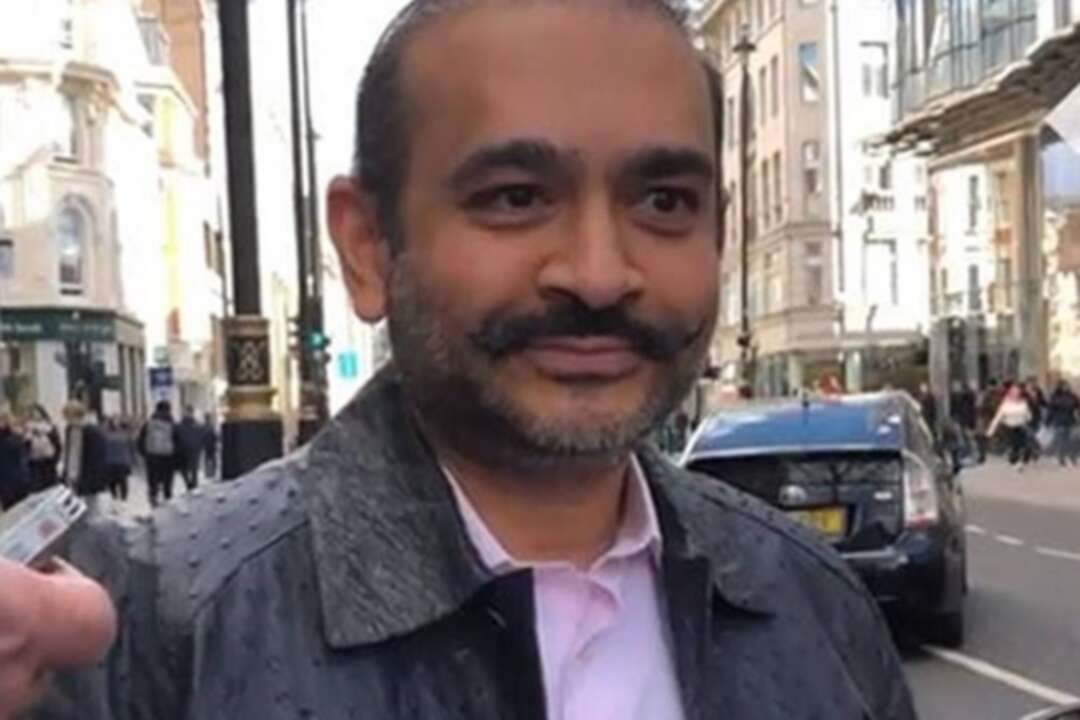

UK High Court gives fugitive Nirav Modi permission to appeal against extradition to India

According to the We For News, the UK High Court approves fugitive diamantaire Nirav Modi’s permission to appeal against extradition to India, on mental health grounds. Nirav Modi

The We For News said, a High Court judge in London on Monday granted fugitive diamond merchant Nirav Modi permission to appeal against a magistrates’ court order in favour of extradition to India to face charges of fraud and money laundering before the Indian courts on mental health and human rights grounds.

It reported, Justice Martin Chamberlain delivered his verdict remotely under COVID-19 rules to conclude that the arguments presented by the 50-year-old diamond merchant’s legal team concerning his “severe depression” and “high risk of suicide” were arguable at a substantial hearing.

It added, he also noted that the adequacy of the measures capable of preventing “successful suicide attempts” at Arthur Road Jail in Mumbai, where Nirav Modi is to be detained upon extradition, also fall within the arguable ambit.

Read more: British military suspends artillery drills due to migrant landings on beach

Justice Chamberlain’s ruling notes, “at this stage, the question for me is simply whether the appellant’s case on these grounds is reasonably arguable. In my judgment, it is. I will grant permission to appeal on Grounds 3 and 4.”

Grounds 3 and 4 relate to Article 3 of the European Convention of Human Rights (ECHR), or the right to life, liberty and security, and Section 91 of the UK’s Criminal Justice Act 2003 related to fitness to plead.

The judge noted that the arguments made under both grounds overlap in this case as they both rely principally on the appellant, Nirav Modi’s mental ill health.

“I will not restrict the basis on which those grounds can be argued, though it seems to me that there should be a particular focus on whether the judge was wrong to reach the conclusion he did, given the evidence as to the severity of the appellant’s

Read more: Beach-goers in Bournemouth, England, leave the sea after ‘large animal’ spotted

Permission to appeal on all other grounds was declined and the case will now proceed for a substantive hearing before the High Court in London under Grounds 3 and 4.

The diamond merchant, wanted in India to face charges of fraud and money laundering in the estimated USD 2-billion Punjab National Bank (PNB) scam case, meanwhile remains at Wandsworth Prison in south-west London.

Nirav Modi is the subject of two sets of criminal proceedings, with the CBI case relating to a large-scale fraud upon PNB through the fraudulent obtaining of letters of undertaking (LoUs) or loan agreements, and the Enforcement Directorate (ED) case relating to the laundering of the proceeds of that fraud.

He also faces two additional charges of ‘causing the disappearance of evidence’ and intimidating witnesses or “criminal intimidation to cause death”, which were added to the CBI case.

India is a designated Part 2 country by virtue of the Extradition Act 2003, which means it is the UK Cabinet minister who has the authority to order a requested person’s extradition after all legal issues are dealt with in the courts.

You May Also Like

Popular Posts

Caricature

BENEFIT AGM approves 10%...

- March 27, 2025

BENEFIT, the Kingdom’s innovator and leading company in Fintech and electronic financial transactions service, held its Annual General Meeting (AGM) at the company’s headquarters in the Seef District.

During the meeting, shareholders approved all items listed on the agenda, including the ratification of the minutes of the previous AGM held on 26 March 2024. The session reviewed and approved the Board’s Annual Report on the company’s activities and financial performance for the fiscal year ended 31 December 2024, and the shareholders expressed their satisfaction with the company’s operational and financial results during the reporting period.

The meeting also reviewed the Independent External Auditor’s Report on the company’s consolidated financial statements for the year ended 31 December 2024. Subsequently, the shareholders approved the audited financial statements for the fiscal year. Based on the Board’s recommendation, the shareholders approved the distribution of a cash dividend equivalent to 10% of the paid-up share capital.

Furthermore, the shareholders endorsed the allocation of a total amount of BD 172,500 as remuneration to the members of the Board for the year ended 31 December 2024, subject to prior clearance by related authorities.

The extension of the current composition of the Board was approved, which includes ten members and one CBB observer, for a further six-month term, expiring in September 2025, pending no objection from the CBB.

The meeting reviewed and approved the Corporate Governance Report for 2024, which affirmed the company’s full compliance with the corporate governance directives issued by the CBB and other applicable regulatory frameworks. The AGM absolved the Board Members of liability for any of their actions during the year ending on 31st December 2024, in accordance with the Commercial Companies Law.

In alignment with regulatory requirements, the session approved the reappointment of Ernst & Young (EY) as the company’s External Auditors for the fiscal year 2025, covering both the parent company and its subsidiaries—Sinnad and Bahrain FinTech Bay. The Board was authorised to determine the external auditors’ professional fees, subject to approval from the CBB, and the meeting concluded with a discussion of any additional issues as per Article (207) of the Commercial Companies Law.

Speaking on the company’s performance, Mr. Mohamed Al Bastaki, Chairman BENEFIT , stated: “In terms of the financial results for 2024, I am pleased to say that the year gone by has also been proved to be a success in delivering tangible results. Growth rate for 2024 was 19 per cent. Revenue for the year was BD 17 M (US$ 45.3 Million) and net profit was 2 Million ($ 5.3 Million).

Mr. Al Bastaki also announced that the Board had formally adopted a new three-year strategic roadmap to commence in 2025. The strategy encompasses a phased international expansion, optimisation of internal operations, enhanced revenue diversification, long-term sustainability initiatives, and the advancement of innovation and digital transformation initiatives across all service lines.

“I extend my sincere appreciation to the CBB for its continued support of BENEFIT and its pivotal role in fostering a stable and progressive regulatory environment for the Kingdom’s banking and financial sector—an environment that has significantly reinforced Bahrain’s standing as a leading financial hub in the region,” said Mr. Al Bastaki. “I would also like to thank our partner banks and valued customers for their trust, and our shareholders for their ongoing encouragement. The achievements of 2024 set a strong precedent, and I am confident they will serve as a foundation for yet another successful and impactful year ahead.”

Chief Executive of BENEFIT; Mr. Abdulwahed AlJanahi commented, “The year 2024 represented another pivotal chapter in BENEFIT ’s evolution. We achieved substantial progress in advancing our digital strategy across multiple sectors, while reinforcing our long-term commitment to the development of Bahrain’s financial services and payments landscape. Throughout the year, we remained firmly aligned with our objective of delivering measurable value to our shareholders, strategic partners, and customers. At the same time, we continued to play an active role in enabling Bahrain’s digital economy by introducing innovative solutions and service enhancements that directly address market needs and future opportunities.”

Mr. AlJanahi affirmed that BENEFIT has successfully developed a robust and well-integrated payment network that connects individuals and businesses across Bahrain, accelerating the adoption of emerging technologies in the banking and financial services sector and reinforcing Bahrain’s position as a growing fintech hub, and added, “Our achievements of the past year reflect a long-term vision to establish a resilient electronic payment infrastructure that supports the Kingdom’s digital economy. Key developments in 2024 included the implementation of central authentication for open banking via BENEFIT Pay”

Mr. AlJanahi concluded by thanking the Board for its strategic direction, the company’s staff for their continued dedication, and the Central Bank of Bahrain, member banks, and shareholders for their valuable partnership and confidence in the company’s long-term vision.

opinion

Report

ads

Newsletter

Subscribe to our mailing list to get the new updates!